|

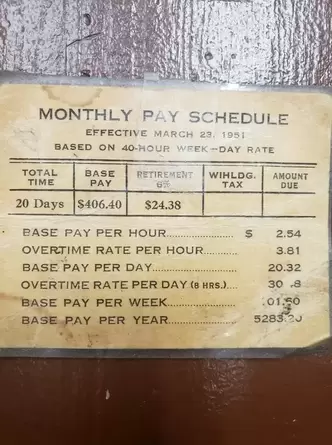

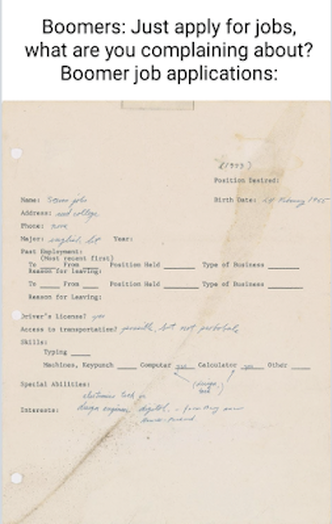

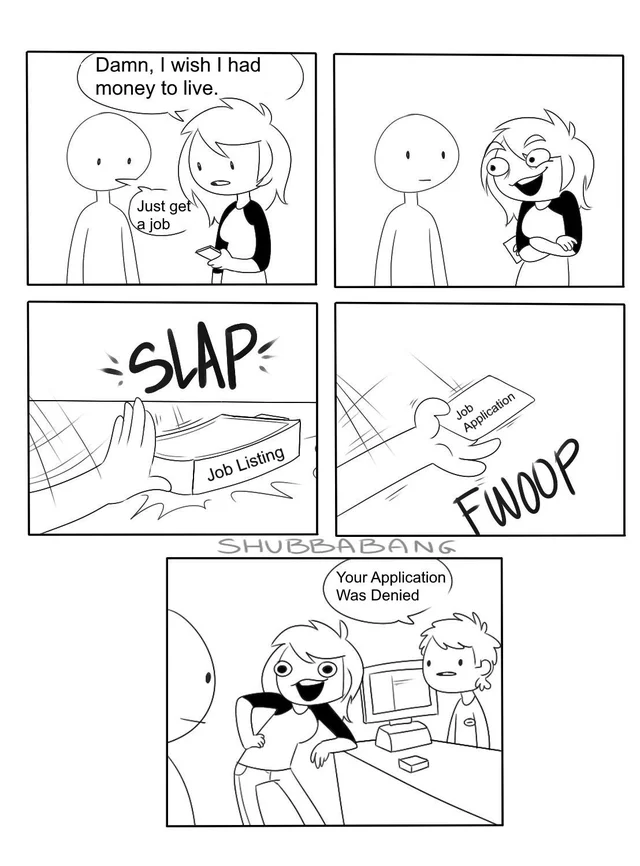

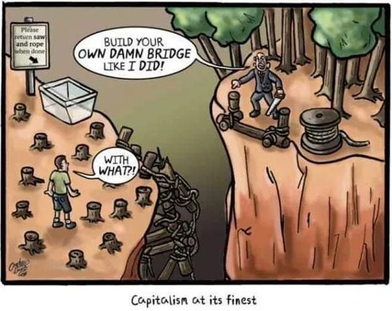

As a nerd for politics and economics, the debate between a flat, or “fair,” tax system and a progressive, marginal tax system intrigues me. I have listened to many debates about the two ideas and it's a subject discussion that I love. I used to be a fan of the flat tax idea, where everyone pays the same rate, but in recent years I've joined the side of favoring the current system of progressive, marginal tax rates, where the poor pay a smaller portion of their income, or none, and wealthier people pay a greater share in each higher bracket of income. Here is my analysis: The main argument for a flat tax is that it is simple, cost effective to implement and regulate, and considered fair as a standalone concept. If the tax rate was 12% of your income, then everyone would pay just that. Wealthier people still pay more because 12% of $250,000 is much more than 12% of $40,000, which is $30,000 vs. $4,800 respectively. The rich pay more because they make more, but it is still the same equal percentage of their income. Arguments in Story Form: PragerU released a video in 2014 titled, "The Progressive Income Tax: A Tale of Three Brothers" which became quite popular and had more than 16.6 million views on YouTube as of late 2020. I felt like I should include my rebuttal to the points made in that video because it includes many examples of why people think the progressive tax system is bad. I actually liked the video and how they depicted the whole scenario, but I believe the message is inaccurate with a few flaws. The three brothers are supposed to represent the general public of our society divided into three economic classes: Rich, middle-class, and poor. The first mistake is assuming that everyone has the exact same starting life circumstances and exact same opportunities. Conservatives love to think America is a perfect meritocracy and everyone has the same, fair chance at success if they just want it by making the right choices and working hard. While it is important to do those things and some people can find success even with bad backgrounds, we do not all have the exact same opportunities or paths to success. Even people in the same career fields can have vastly different economic outcomes. The video also insinuates that people that aren't financially successful just don't make good choices and don't want to work. Market forces do not compensate based on how hard people work. Conservatives have this obsession with the idea that the harder your job is and more hours you're putting in (if you're even allowed to put in more hours at work), then you'll make exponentially more money. The poor and middle class are described as not saving or investing by choice because they don't care, never mind the fact that the cost of living for basics is using up every dollar they've got, or at least a large portion of it. It's easier to save and invest when you have more disposable income to save and invest. I also noticed that the wives of the three brothers have very different careers which can affect the family's economic outcome. It's a lesser point in general, but the wives could come from varying family/wealth situations which will also have an economic impact. Besides the different careers they have, what about details such as how much debt they had before getting married including things like student loans, car loans, and credit card debt? Maybe the parents of the rich wife paid for her college and gifted her a car. She's already much better off than the others because of things like that. The community the three brothers move into is supposed to represent the country as a whole. The improvements are a representation of the three classes of society working together to build and improve the country. It costs money, in taxes, to build and maintain the country's infrastructure and security, so the flat tax argument is made stating that it's fair because everyone pays the same proportion of their income and enjoys the same benefits. In the microcosm setting of this video, yes, the progressive tax does seem unfair, but the analogy fails to accurately represent all factors at play in the real world. Harry, the rich brother, is upset that under the progressive tax he must pay 80% of the bill even though they're all receiving the exact same benefits, but are we all really receiving the exact same benefits that living in this country has to offer? This video depicts our society as everyone having the same exact opportunities and backgrounds and enjoying the same or similar quality of life and benefits while making Harry (the rich) pay for it. Sure, we all enjoy the same public use facilities, infrastructure, and military protection, but people can enjoy those basic things in many, or most countries of the world. What we hope makes America, or any country, a better place than others is the quality of life and opportunities for economic advancement afforded to its citizens. A flat tax sounds fair but does not produce the best quality of life for a society and limits the amount of opportunities the poor will have because their tax burden inhibits savings and discretionary income. In reality, the three brothers (or classes of people) would never live in the same community with the same benefits. Rich Harry wouldn't want to live in the same poor neighborhood as Tom. Harry would want to live somewhere with less crime, cleaner and well-maintained property, and larger, more luxurious homes. Tom can't afford better. Also, most poor people don't just work a mere 20 hours per week. They still work 40 hours or more with multiple jobs sometimes that just don't pay as much because they aren't in white collar, high paying careers. Market forces do not compensate based on how hard people work; and to portray the lower-earning class of society as just choosing to work less is offensive and incredibly ignorant. The video indicates that Harry (the rich), is being forced to pay for all the upkeep of the country as if no one else is invested in the country and economy in any other way. The poor and middle class still provide the majority of labor to fill jobs in the economy and manage/operate businesses for the rich investors, creating wealth for themselves and especially for the rich. In a progressive tax system, the rich pay the most in taxes to pay for the country's security and infrastructure and the poor pay for the luxurious lifestyle of the rich through their time and services working for their companies and through the consumption of the goods and services offered by the businesses and investments. This PragerU video is also hinting at the idea that what you pay to the government in taxes should reap proportionate benefits. No. Paying taxes isn't shopping from the government as if you're buying fruit by the pound. You don't necessarily get more benefits directly from paying more taxes, and you don't receive less for paying less. You also don’t get a say in what specific programs you want to dedicate your taxes to. That’s only generally done through elected officials. However, there are indirect benefits as I will expound on later. I came across two more allegories that try framing a progressive tax system as unfair and absurd that I want to comment on: 2nd Allegory: You are now the tax collector assigned the job of collecting taxes & deciding the fair share of each person. There is a new government program called Beautify Our City (BOC). It provides jobs for low-income folks, reducing the number of people collecting unemployment, and also helps make the city beautiful and increases property values. The unemployed now will provide lawn mowing, bush trimming, etc. for each home in the city. The program is mandatory for all residents to pay for. Your job is to knock on doors to introduce the new program to each home. You go to the first home, one that could really use this program. The grass is tall, the bushes are overgrown, etc. You knock on the door and a man in his 30s answers the door. There is a distinct smell of too many dogs in the house. You explain the new program. The man says that sounds great but what is it going to cost him because he doesn't have any money. He was laid off from his job 6 months ago & he is collecting unemployment. You mention that the new BOC program has a job for him, but he explains that he's been sick and can't do that. So you say, "That's OK. If you don't have any money, your cost is zero." You go to the next house and explain the new BOC program. This house has an immaculate lawn. The bushes look beautiful and clearly, extra attention and money, has been lavished on this property. The man at the house says he doesn't need this program. He takes good care of his property and likes doing it. You patiently explain that it's a mandatory program. The man says ok, but what is it going to cost? You reply, "How much do you have?" The man responds, "What!?" You patiently explain that each person must pay their fair share. The price for the lawn care is 'progressive' meaning people that have more money must pay more for the same services that others pay less. The man gets angry and slams the door. The BOC program is mandatory and, as a city official, you have police powers. So the next day you knock on the man's door again. But this time you have 2 uniformed police officers with you. They are carrying firearms. You knock on the door and the man answers. You patiently explain the BOC program again and emphasize that it's mandatory. Seeing the two police officers the man sighs, realizing he doesn't have any choice. So he again asks how much. You reply, "How much money do you have?" 3rd Allegory: You go to the grocery store to buy eggs, but you don't see a price tag on the eggs. Hmm. So you ask the first clerk you see and ask, "What is the price?" The clerk says you have to go to the front office & tell them how much money you make. When the front office knows how much money you make, only then will they be able to tell you the price you must pay. That's the only way to determine a "fair" price for you to pay. My response: The underlying problem these stories share is that people that have more money are being asked to pay more for the exact same products/services others receive at lower prices. They're arguing the moral case of how this is unfair for them to be tasked with the burden of funding society's programs that others are using for less of a cost. I think this is a childish viewpoint of oversimplification and misunderstanding the purpose of taxes and an organized society. The purpose of taxation and its subsequent spending is to strengthen the economy by providing safety and infrastructure for good commerce and providing opportunities for everyone to flourish, make the American Dream possible. So what exactly is the good or service the government provides that makes the rich pay more for and the poor pay less of. Safety? Infrastructure? These stories make it sound like you should be mad when you have to pay for emergency services when you’ve never needed to call for police or a fire department. Should I be mad that I have to pay for road construction and maintenance on highways I never use? Never mind the fact that maybe delivery trucks and employees of my favorite stores may use those roads and highways. Having a rich person pay more for eggs like the 3rd story above, is like asking a tall person to reach something on the top shelf for you instead of making all the poor have to buy stools. A poor person doesn’t make enough to get by with basics on the lower wage jobs they work to provide cheaper goods and services for all, so they need financial subsidies and you get mad that you have to pay higher taxes to pay for those subsidies? Then say crap like these low wage jobs should only be done by teenagers or starter jobs even though the position needs to be filled during school hours, or how raising wages means costs go up for everyone. Ok, so you like cheap goods, but it’s really at the employee’s expense then because they can’t afford to live on the low wages. The main point for this topic is not about minimum wage issues, though. It’s about comparing a flat tax to a progressive tax. If the poorest among us are paying the same level of taxes, it will cost them more of what’s needed for basic survival, not just costs in luxuries and additional comforts. It doesn’t make sense to have them pay for their own subsidies, services, and infrastructure when they already can’t afford much as is. If you like cheap goods and services, and having a safe, cohesive society, and a strong economy where more people have disposable income to contribute to growing businesses both big and small, then it makes sense to me to have the higher earnings pay for more to offset the costs. Everyone pays the same rate in certain income brackets. Those tat make more in excess of those average amounts will pay a greater percentage and they still reap a greater reward of living in comfort that our society and economy provide. People should do what they can to get better jobs, but there’s always going to be low wage jobs needing filled. I think asking the rich to pay for the roads their customers and employees use to work at and patronize their businesses which make them rich is fair. It’s still a positive trade off. I’m not asking for complete communism equality. I only suggest a progressive tax system is more effective at providing for a stronger economy. I created my own story using the example of the same three brothers to represent economic classes in society. Each of those brothers had a daughter, so this next generation of three cousins decided to make a living by going in together on buying an orchard. Harry's daughter has no debt, her education, first car, and a down payment on a house has been provided for by her father Harry. She was married a rich fellow and was willing to pay for more than half of the orchard to own with her cousins. Dick's daughter had some college paid for, but still worked hard to build a successful career. She made a good contribution to invest in the orchard and will work as the manager of it. Tom's daughter grew up poor, but worked her way through school with the help of student loans and carries that debt burden. She doesn't have any savings but was able to make arrangements to buy into the orchard with her cousins with her labor. The girls were going to live by the fair standards their fathers originally intended and split the costs evenly according to their ownership portion. If they each paid 12% of their income, the costs will be covered. The orchard produced well and grew in popularity, but over time the land around it started developing and costs began increasing. The rich woman pays the most in costs because she takes most of the fruit sale proceeds, but this still feels like a fair arrangement. She is unaffected by the increase in costs as the orchard is still quite profitable to her lifestyle. She doesn't really work the orchard, just checks in occasionally and voices her opinion on decision making. Dick’s daughter, serving as the manager, pays her dues and is still able to take some home, but that portion is becoming less with rising costs of running things. She works the administrative side of things and often helps out with the labor. The poor woman operates the most physical work required to run the orchard and does a great job, but she has little left to get by on after the costs are deducted. She needs government assistance until she can find ways to improve. More people on assistance leads their local government to increase tax costs. The poor woman's tax increase is offset by the benefits she now receives to help with basic needs. Manager cousin is mad that she gets even less now after all the hard work she puts in, and rich cousin is annoyed, but her lifestyle is still mostly unscathed by the changes. The three cousins schedule a time to discuss the affairs of the orchard. The poor cousin thinks the rich cousin should pay a more "fair share" of the costs because she's still taking most of the proceeds. “If you’re taking 50% of the profits, you should be paying 50% of the costs too," she contended. The rich cousin scoffed, “I AM paying half the costs. Do the math. And, of course I am taking the most profit. I invested the most, so I deserve the most. We are all paying an equal portion for the same benefits. Isn't that fair enough?" The manager cousin knew that having the rich cousin pay more because she could would mean that she herself would be able to keep more of what she made as well. Besides, she worked hard with her contributions to the orchard as well, so she chimed in, "I don't think you could really say we all benefit equally." Nodding to the direction of her poor cousin she continued, "She and I are the ones providing all the work here too, but only receiving enough to barely make ends meet. We soon won't be able to even afford the transportation or housing to get to work here. Also, we are losing sales because the neighbor workers can't afford anything else either. They used to buy from us, but now they can't afford it since the cost increases. Listen, without your investment, we wouldn't have this big, successful orchard; but without us working it, you wouldn't be enjoying the large profits either. We need each other. Besides, it's not like you're hurting any if you pay a little more." The rich cousin was offended. "Fine. If you two are against me, then maybe I'll just sell it and leave." The other two were stunned. It was still a profitable enterprise. If their rich cousin didn't want to enjoy the benefits, then maybe splitting it with more of their other friends and family would appreciate it. They were able to get other people to split the difference and some even helped work the land as well. End of story. Ok, maybe sloppy, go ahead and poke it apart. I tried, but I hope I got at least a summation of my thoughts across. Is it unfair to require the richest to pay more just because they can do so easier? You know? I'll admit, it does look that way, but it's also unfair, in the grand scheme of an economy, when the people staffing the business that the rich own and invest in, can't even afford to live with the basic housing, food and other necessities to be able to keep working at these places. It's not fair when the rich gain disproportional influence in politics and control over markets with their wealth. See this post. Now to further build on the concept I brought up earlier about the benefits populations enjoy from taxes. What are the benefits and privileges enjoyed by the rich and poor and how does it compare to what they have to pay for in taxes? People argue that we all enjoy the same benefits and general opportunities, like the PragerU video states, but does that just mean sharing the use of public infrastructure and safety through regulations and military protection? That’s it? Seems like a pretty low bar since most countries have basic infrastructure, safety, and varying degrees of rights and ability to do business. Big whoop. What about economic power and opportunities? I consider the quality of life afforded by the country's peace and prosperity to be the most important benefit of good governance and optimal tax policies. For example, a person who owns a Rolls Royce pays more for insurance than a person who owns a Ford Fiesta. They’re both cars that drive, but one is travelling in much more prestige and luxury, so they pay more in insurance to cover it for protection. Thus, the assets of the rich are more luxurious and protected by our society’s gains, so they should be paying more in taxes to protect that lifestyle and those assets. The indirect benefits the rich enjoy include profitable investment opportunities, markets for business opportunities, a large supply of skilled and educated workforce, a thriving entertainment industry with movies, music, social media, and events, big money in many different sports industries, and the many, many luxury goods and services a wealthy, safe, and stable country provides to those who make the most money to access these. Even the poorest have a better quality of life compared to other nations, but I think it can be even better. Why it’s needed: The problems a flat tax causes come from the way it effects the poorest. There is a certain level of income needed where families no longer need every last dollar just to afford all their basic bills and then after that point people start to have savings and discretionary income where they can participate more in growing an economy. Like my example at the beginning, if a family only earning $40,000 has to pay a flat tax of 12% of their income, which is $4,800, what can they no longer afford now? What have you taken from them? Maybe 3 months’ rent. 4-5 months of food. 4-5 months car payments, etc. They are pinching every last penny just to pay for basic shelter, groceries, utilities, and a few other necessary goods. They have nothing left to save or pay into other things in an economy. Take 12% from someone who makes a million dollars a year and what necessities can they no longer afford? What comforts are denied to them? Virtually none. They still have $880,000 left over to afford almost every comfort on earth. 12% of the middle class $150,000 is $18,000, which can feel like it hurts, but they should still easily have basic needs met and a good amount of discretionary income. The cost of living creep is real where having a bigger house or more stuff because you have more money is a factor, but the poorest are already living pretty low standards comparatively and there’s not much worse they should be forced to endure just to pay the tax bill of the flat tax. Instead of going without food, healthcare, vehicle maintenance, and other needs, the millionaires and upper middle class might have to take less extravagant vacations and essentially just lose out on more frivolous luxury instead of necessity. There's a big difference in sacrifice between the two groups! The problem with going after the poorest with regressive taxes, even a flat tax which will hurt them more, is that when people have to struggle even more than they already are, resentment and unrest build. The economy becomes stagnant with more people having less resources, killing demand. Economic inequality will continue to grow apart, leading to more crime, more civil unrest, an increasingly polarized nation, and the rise of more extremism in politics. Now I'm not arguing for full equality where everyone should have the same income, but I believe there should be more equality in opportunities and at least quite a bit less inequality for a more happy and stable society. People that work hard to avoid debts and go through rigorous school programs for high-paying careers do deserve their reward, but having them pay a larger percentage in taxes after reaching high earning numbers doesn't hurt their overall well-being and contributes to a stronger society. Even when a larger percentage of their income is paid to taxes, they still take home more than everyone else and can still afford a more comfortable lifestyle than everyone else and provide for a better society at the same time. The remaining take home pay for the poor isn’t enough. People need government subsidized housing, food, medicine, and more just to have basic needs met. Some may argue we’d be better off if government just didn’t provide those because people and markets would just “figure it out.” We had that chance to see this in history before these programs were implemented. They didn’t figure it out. There was crippling poverty and suffering. Why it’s better: If you want to keep your lower wages and cheap goods, then you need to provide for the subsidies people need to live. People working full-time jobs aren’t earning enough to make ends meet. People should do what they can to get better jobs, but these are still jobs that need filled. People that do them shouldn’t be forced to endure an impoverished lifestyle. If people are keeping more of their own money after meeting basic needs, that extra disposable income goes into the economy. More people would then have the power to save, invest, and maybe start their own business ventures. I believe I have covered the reason why it is fair to ask for the rich to pay a greater share and the poor to pay less or nothing at all from the poorest among us, but If I need to clarify that further please let me know. To answer why a progressive tax is better, comes down to combatting economic inequality by providing better equality for economic opportunity and fostering economic growth. Both are done through strengthening the middle class. Building on PragerU's three brothers analogy, Harry's children in the future of the video will have much better opportunities and earning/savings potential than their cousins from Tom & Dick's families because Harry's kids are far more likely to attend good private schools, have college and/or other major expenses paid for, and receive greater financial gifts or job networking from their parents. I agree that Harry is allowed to support his children in those ways, but you can quickly see how the economic opportunities will already be different. Maybe Tom's kids had to work through college or put off college because the family needed their income for support due to rising costs. Maybe Dick's family suffers from crippling medical debt when either Dick or his wife are now unable to work due to a medical condition. Their kids will not have the same access to the opportunities Harry's kids enjoy. Yes, everyone in the next generation can work hard and make good choices, but a greater investment in policies that foster middle class growth can help even the playing field of opportunity to compensate for these differences, such as providing affordable education, healthcare, and social safety nets. The first point addresses economic opportunity. The second point for why the progressive tax is better addresses fostering economic growth. An economy doesn't grow much without demand. Businesses need customers and operating money, but customers also need money from wages earned at their own place of employment. Business is cutting costs wherever you can while maintaining or improving efficiency for profit. Employee wages are costs. Employee benefits are costs. Sponsoring community events and little league teams are costs. When the concentration of wealth is too lofty in the top, demand and growth is stifled. When the cost of living is too high and wages too low the cash flow from customers dries up and the general economy starts to stagnate or decline. Less people controlling more of the nation's wealth and investment stifles growth. It's putting bottlenecks in the cycle. Instead of hurting the well-being of the poorest as a flat tax would, a progressive tax takes a larger share from the pool at the top and, if executed properly, reinvests it into jobs, infrastructure, education, healthcare, and other social safety nets, creating more equal economic opportunities for people to take risks on their own business ventures, provide more opportunities for more people to become investors, and create an environment for businesses to thrive on new and growing demands. Nobody's overall well-being would be hurt by this. Even the richest paying the highest percentage of their income in taxes are still reaping the rewards of their industry, still have more money than anyone, and can still afford virtually every comfort on earth. If more people have money to purchase the goods and services provided by the rich, then they'll still grow richer despite the taxes. In closing, I wanted to include some comments about taxes in general that really irritate me. A big one is the notion that the rich are the "producers" and "productive" members in the economy, insinuating that everyone working for wages and earning less than...a lot, are just lazier and don't contribute very much to society. I've heard the argument that a tax on capital gains, interest, and dividends is a tax on capital and this is bad because "You're shifting from the productive sector of the economy to the unproductive. Don't tax the 'producers' and 'investors.' You're penalizing people who produce! Progressive taxes are unjust!" Then, they continue to talk about how the rich deserve everything they earn because they are "more productive" and useful to society. Yes, Tom Cruise, the Kardashians, LeBron James, Mr. Beast, and the assortment of wealthy YouTube and streamer stars are far more productive and useful than most Americans, right? I guess you could make an argument for that, but no I think they're only thinking of wealthy executives, business owners, and wealthy professionals when they are referring to people that are "productive." In fact, rich people, in their opinions, should maybe pay less in taxes because they create jobs and growth in the economy, right? If you work, you should pay more in taxes than those simply living off of investment income and business profits, not working. They've done enough for society and their wealth continues to bless us all. Let us pay their taxes for them to thank them for their service to society. Let’s give them a free ride so they can create more jobs with their great benevolence. Nonsense! This argument leads to the gist of the conservative, trickle-down economics theory and here's where I find problems with it: 1. It ignores demand. Rich people don't just open up businesses or create jobs at random unless there is a demand for their product/services to make a profit. They also don't grow and hire people unless the demand requires it because they are doing so well and need hired help to get bigger. Maybe there are niche cases of someone doing a favor for a connection. 2. This philosophy assumes businesses aren't growing simply because they don't have enough money, so their taxes are cut to let them keep more of their earnings to have more money available. Again, it's a demand issue. Not enough people are buying their products/services to warrant growth. Getting funding is easy for businesses that are doing well and want to expand. Tax cuts can often provide short-term growth by accelerating expansion plans with the extra money, but if the demand and customer base is low then they aren't likely to expand, even with the extra money. 3. This idea is that the rich, or job creators, should never pay any taxes because they create jobs with that money instead. All employees be damned. They should pay for all of society's needs, but if the employees pay more of the taxes and receive poor wages, there's less money to be used to grow business anywhere. All their money is being used up on basics like housing, groceries, utilities, and transportation. No discretionary income for anything else, no demand for other goods and services, no economic growth. This whole subject becomes a debate on finding equilibrium between supply-side and demand-side economics. "What comes first the business or the customer?" Business? Ok, where did the business come from? Investor(s) that wants to make money from a profitable business. Businesses are profitable from lots of sales and good margins. Lots of sales come from customers. We get more growth by investors putting in new businesses, right? If pure capitalism creates jobs, why can't we easily fix any recession and develop any region by putting in more car dealerships? Those create jobs, but they won't last because there isn't money flowing or a demand! Build luxury goods stores in the poorest neighborhoods to provide great-paying jobs to the poor people in need. No. There's no demand, no customers because the people don't have little to no discretionary income. Obviously, those are examples of terrible business placement decisions, but a whole mall with a variety of in-demand stores could be built during a recession or to develop an area, but the majority would still fail because customers don't have enough money and those jobs pay so terribly that employees can't even afford to shop at each other's stores. Here's the big takeaway: Supply without demand is waste, demand without supply is opportunity. That opportunity is when businesses are built. There is much more to investment than rich people and corporations just not having enough money. They already have plenty of money or easy access to more if needed. It's the poor and middle class that need more money to grow and start their own businesses. Doesn't the job have to come before demand because that's where people get their money? Yes and No. Yes, most people get their money from jobs, but the owner of my company isn't paying me from his personal money under his mattress. He's paying me with money earned from clients because of the work I do. I do all the work for the clients, but he takes a cut for facilitating the transaction by providing the business and supplies. Sure, I wouldn't have a job without his business, but he also wouldn't have a business without me doing that particular job. He can't do all of the jobs himself and THIS is why it bothers me when people refer to the rich as being “more productive.” I'm glad for people that live their dream of obtaining financial success, but don't discredit the hard work that all wage earners put in, regardless of how much or how little they earn on an hourly basis. They are the ones actually working and providing the service or product the business sells, sometimes right alongside the company owners. What many people complain about the most is how much of the money earned from doing the job is taken as the owner's cut for providing the business and supplies. I do agree it's fair for them to take a modest amount, but what really rattles people is when business owners and executives suck up all the money and "rob" employees of their earnings they provided through their work by paying them poverty wages. So the question is asked, why is it considered "robbed" if wages are fairly based on supply and demand? That’s a question I’d like to explore another time in deciding where the line is and what’s considered fair. Business owners and executives are compensated greatly when successful, but employees are most often just compensated with the same low wages, regardless of making record sales. Maybe a small bonus will be there somewhere at the end of the year. P.S. Additions Another argument made is that rich people will be disincentivized to earn another dollar if they reach the ceiling and the next tax bracket it too high, or that progressive taxes incentive laziness. People that say this might not understand what marginal taxes means. If you're taxed at 12% to $100,000, then 15% at $100,001, that doesn't mean you all the sudden have to pay $15,000.15 for 15% of all your income! No! You will pay $12,000.15 - 12% of the $100,000 and 15% of every dollar earned after that. The point is, you still earn money! I guess businesses are going to turn away customers instead of growing and making more money? Then maybe new businesses will take those customers that were turned away and the market share is spread, increasing competition, which is good for customers and employees, right? Solutions business owners could do to avoid that scary tax ceiling they're so scared of is either a)pay employees more to not make so much profit to be taxed, b)charge less for products/services, c) shut down for the year and deal with hiring seasonal employees or new people every year, or d) continue to grow and expand to make more money, but at a lesser rate moving forward. I can only understand being disincentivized to continue operations if the tax is so incredibly high that it actually is prohibitive. I’ve had to clarify this last point several time to people. I am not advocating for everyone to make equal pay or close to it. I just advocate for having the rich and richest pay more, but also not an unrealistic, impossible amount. I’m still trying to be fair and reasonable here!

Another point I want to mention is that people often say that higher taxes infringe freedom. How? Just because there's less money for you to use as you please? Ok, I guess, so then you would agree that the poor and lower middle-class people are enslaved with hardly any freedom because they have hardly any money? I guess I can maybe be persuaded to see that you have less freedom if the government is taking too much of your earnings. Again, there is a better balance that can be found.

0 Comments

Getting a college degree is expensive, but practically required for any decent job today unless go a different route working in the trades for a career. I don't believe it's possible for someone to be able to pay for their own living expenses and college tuition and other expenses without scholarships or loans. I've had a few discussions and debates with people on this subject and have usually found that those who did it had their parents pay for some or all of the following: housing, vehicle, food, insurance, phone, whatever else. That doesn't count! You got hooked up by your parents, so your expenses were less. I'm doing the math to see how much it costs to cover everything on your own.

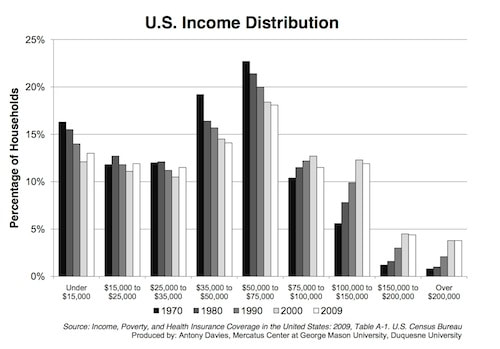

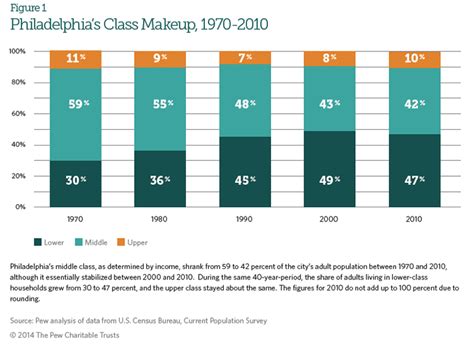

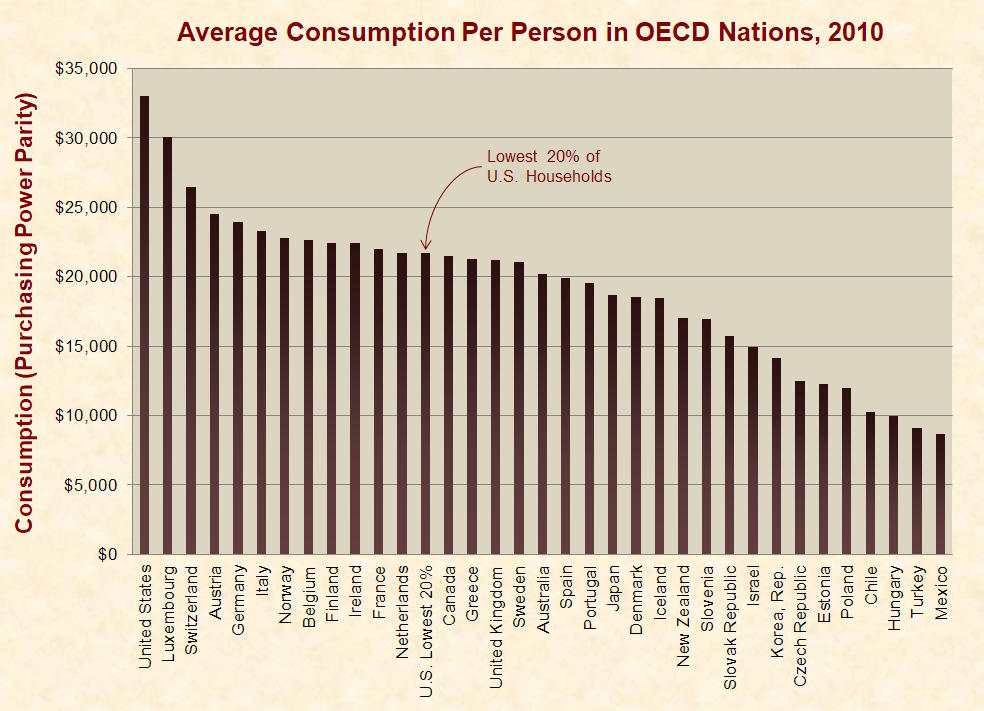

2023 Information Tuition: $4,391/full-time semester Books & Supplies: $620 Food & Housing: $5,688 Transportation: $1,248 Total: $11,947 Source for my numbers: https://www.boisestate.edu/vpfa-budget-and-planning/tuition-and-fees/ For a 4-month semester, $11,947/4 months = $2,986.75/month $2,986.75/4 weeks/40hrs means a student here would need a full-time, 40hr job paying at least $18.67/hr AFTER taxes. About $750 a week. Probably a $21/hr job needed because of the tax and benefit deductions, working full-time while going to school full-time - and this didn't even account for extra spending money or a variety of other expenses and utility costs. In Boise, Idaho a college student earning $21/hr is rare! Maybe some people get lucky and find good income to make it work or earn good scholarships to help with the costs. The overwhelming majority don't. I had a friend that would work through college, but he worked for his dad's company that paid him well and he didn't have to waste any time applying for jobs or anything like that. Scholarships are great if you can earn them. I heard all the time how there were tons of small scholarships out there for the taking by anyone, but I felt like I was just wasting my time writing and submitting dozens of essays and doing some leg for just a small chance at a scholarship. I didn't want to do all that work unless I knew it would actually produce results for me. I got tired of losing and spending hours and mental exertion for a small chance at a $500 or $1,000 scholarship. Unless you get good scholarships and/or have family pay your way, I think you HAVE to get student loans. Gone are the days one could simply work their way through it unless you get very lucky or figure out other means. Please share your story if that's the case. I'd love to know how you made it. I’ve had some conversations with people that were going against the grain saying, “things have never been better! People complaining just don’t know anything!” I come across this type of thinking once in a while and it’s just weird to me how they ignore the reality a lot of people face today with their quality of life and finances. The people saying the opposite, that’s things are better than ever for everyone, do at least try to back up claims with some economic studies and graphs though, so it’s good conversation. This was one online conversation I had with someone. They started out by stating: In the US, there's an increasing number of people from both sides that try to claim the average American's standard of living has gone down and blame it on the other side. This is simply not the case, as all economic and production figures show. So, I engaged this and said, “The average standard of living HAS gone down. It's getting harder and harder for people starting out to live a comfortable, middle-class life. Housing and education are getting too expensive too fast. Wages aren't keeping up to compensate.” I laid out my evidence for comparison to consider: Median Price of a home in 1980: $47,200 vs 2020: $391,900. Median Family income 1980: $21,020 2020: $71,456 Home price as percentage of income 1980: 225% 2020: 548% Median tuition cost of Boise State University resident 1980: $239 2020: $4,030 Tuition price as percentage of income 1980: 1.14% 2020: 5.64% “GDP is increasing, good, but the rewards aren't being enjoyed by majority of the population. GDP doesn’t mean that it’s money in everyone’s bank. It’s too concentrated in the hands of a few. Corporations enjoying record profits are also enjoying large amounts of stock buybacks - not wage or bonus increases. A strong GDP doesn't matter as much when the rewards are too concentrated in benefitting those that are already well off. I came of age to graduate university, get a decent job, and buy a house about 6 years after my brother. My brother's college tuition was about a thousand less per semester AT THE SAME SCHOOL! He got a nice, 5-bedroom house with below ground pool and hot tub for $350,000. 6 years later, that same house is worth $650,000. I had to pay $400,000 for a starter home in the same town. 3 bed/2 bath, 1,400 sq. ft., no pool or anything nice. Job wages are pretty much the same, maybe a dollar higher. I'm stuck paying more for less for the next 30 years. More for the same education and more for a lesser house. I will forever have less disposal income than people that "came of age" at a better time and less savings or opportunities because of this unless something happens, like one could argue, I could've gone to a different university or move away instead to a cheaper place. Maybe true, but this increasing cost of living is happening just about everywhere, and it's pathetic that in a country with supposedly booming stats you listed that people should have to keep moving out to the frontiers instead of life getting better for future generations as has been the case for the previous 200 years.” Here's the first response I got: I'd argue that house prices are just asset prices and therefore not a good measure of quality of life. If you, the buyer, suffers in terms of quality of life, then the seller benefits just as much. Increases in tuition prices are due to higher wages for professors and more resources devoted to research rather than just teaching, which means your higher tuition goes into increasing the knowledge of humanity as a whole. Me: “’If you, the buyer, suffers in terms of quality of life, then the seller benefits just as much.’ Obviously, I hope my ‘asset’ appreciates for me to sell and make a good buck from it too, but this still neglects the facts I laid out about the cost of living getting too out of hand for up-and-coming generations. This just reinforces the idea that everyone that got theirs sooner continue to get boosted wealth at the expense of future generations’ detriment, so again, it’s GREAT for the rich or at least those already on the path to building wealth, but for anyone starting out it’s getting more difficult. Unless you're in the very few high paying careers, it's getting tougher to have the comforts or even necessities of disposal income previous people and generations enjoyed. Everything you mentioned shows that the economy is good for everyone that already got theirs, and it's getting better for them, I think, but for everyone else starting out, I still don't see how you show they have it better than ever. There's no way! Wages are up some overall, sure, but some of the crucial expenses (stats I listed) have gone up at far higher rates, thus diminishing the wage increases. I mean, I'm still open to be proven wrong. Maybe I'm missing it. How can these stats be interpreted to say we have it better than ever, when my grandfather could pay for a college degree with a part time ‘high school kid summer job’ then work a common office or factory job and afford a nice house with an acre of land, rental properties, new cars, and lavish vacations, all on just his income, living in a big city, and acquiring these within 10 years of graduating? The same job now pays $50k-$80k. Hard to make all that happen today. It's anecdotal, yes, but there are thousands of examples like this everywhere.” Second response to me: I agree if you focus too much on housing and tuition (which seems to be your biggest focus), it may seem like a drop in standard of living; but I'm willing to suggest you grandfather's cars, which were considered ‘high end’ back then, was as good as a low-end car today. And for the vacation, weren't plane tickets much more expensive back then? And if you mean a road trip by vacation, he'd have to drive with a low-end car (by today's standards) on a worse highway than you have now. And this is not considering he didn't have access to an incredible library of knowledge like the device you're using. These are just a few examples, and there are other examples of things we have much better now thanks to technology. The conversation wound down and basically ended there, but I regret not going hard again on the emphasis of their last sentence. I should be grateful for my contributions… OK, the whole POINT of the conversation, was about why people are pessimistic about how the future is looking bleak. Instead of answering to how it’s better, we should be grateful or proud of our contribution to lining the pockets of universities, to student loan interest, and to the banks and previous owners of houses, at our expense and the expense of our ability to save and thrive. Why do I “focus too much on housing and tuition?” Because those are typically the two best steps to building wealth – an education for a better paying career and building homeowner equity wealth. If people are spending too much of their income on housing and student loan payments, there isn’t enough left to save and invest or contribute more actively in the economy. They also pivoted to the advancements in technology instead of addressing the issues. I see this happen often when cost of living challenges are discussed. I am grateful for the advancements in things like technology and medicine. I just wish I could enjoy them more if I could afford it. I think of the analogy of having to run on a treadmill for a prize. It’s slower and basic for the first contestants. New people joining the challenge get newer treadmills that come with a fan and virtual reality environment, but it moves at a much faster pace. The new contestants get to enjoy more luxury but have to work harder for the same prize. The prize of financial stability and comfortable disposable income. I might agree with this person that things are generally pretty good and improving for those that secured their middle class or higher position (good career underway, home ownership, low student loans or none), but for everyone else coming of age trying to afford the education costs, first time home buying, and other things, it feels like a real struggle and missed opportunities compared to what our peers enjoy even though they followed the exact same path, just doing it sooner when it was all more affordable. Another Conversation: There’s some kind of data studies that resulted in the info found in these graphs. They're used as evidence to argue everyone is better off and here’s the proof. Ignore the reality of the struggles you’re facing. This chart proves you’re better off! Here’s another conversation I had with someone using this chart, but it felt like a failed conversation because this person just spouted off a whole bunch of weird stats and wouldn’t address anything I said. Maybe I was speaking to a bot: The Middle Class is disappearing because they are moving into the upper class. This is demonstrably true. The poor are also getting better over time. Then when you add in government transfers the picture is even better. 1/3 of US households now have an annual income over $100,000. I can give you the data. The error that is usually made is that people look at the middle class shrinking (It is. The data says that) but assume they are becoming poor. That’s just not true! The data doesn’t support that. That’s a political narrative. The poor have been reduced by about 10% since 1967, the middle class reduced over 11%, and the rich increased by about 20%." My first comment: “It's weird hearing (reading) people go against the grain stating stuff like this like how things are better than ever and we're all crazy for thinking times are getting tougher. I've seen this guy's presentation and exchanged an email chain of conversation with him. I'm impressed with his willingness and availability to communicate openly. One thing he failed to deliver on, though, is reconcile these stats with how the cost of living is without a doubt different/worse now than it was 40-70 years ago. This may be proof that there are more people earning higher incomes, which is good, but people in the lower two brackets are getting crushed harder than they were before. For example, university costs (in America at least) and housing costs are two of the biggest lifelong investments to building wealth. The cost of these are way higher for percentage of average income than ever. For people that got theirs sooner, great, you're doing well. For people starting out trying to pay for college and buy their first home at these astronomical prices, they're suffering, and it only seems to be getting worse for the middle- and low-income groups, even if they are, technically, becoming a smaller group overall.” Their first response to me: With Covid and the general incompetence of the Federal Reserve and Government. What we are experiencing now is not typical. It is exceptional. To take something exceptional and hold it up as typical would be intellectually dishonest. People often look at a snapshot in time. That can often be misleading. I am looking at it over time. Would you have said what you are saying now in 2018? Maybe not. I spend thousands of hours studying this kind of thing. I give lectures on it. An epistemological razor is something philosophical that whittles away something or makes it smaller. An example of this would be Hitchens’ razor. Hitchens’ razor states that which is asserted without evidence, can be dismissed without evidence. So, the goal post has been moved. I had no idea what they were going on about COVID for or looking at why I wouldn’t be saying this stuff in 2018. They lost me and never cleared it up when I asked, but I did respond to the statements about us doing better than Europe and OECD countries. I said, “This is great! Aren't we so lucky? It sounds like you're making the case that everything is better than ever, right? And people are only manipulated to thinking the opposite, that we're getting poorer. I can understand that overall income + transfers and whatnot may show as everyone doing better and making more money than ever before, but I still don't understand how it reconciles with the cost of living for goods, especially housing and university costs, outpacing that income growth. If incomes are up, but costs up even more, than it's getting worse for the lower incomes! Is this not actually the case? There's hundreds of examples out there of buying power going WAAAY farther 50 years ago or so. There's whole threads about it like this one.” Again, they’re not addressing the difference in increasing cost of living and how it’s getting harder. They’re deflecting again now by comparing us to other nations. I've heard this argument a few times too. Comparing to similar economic countries is better, but I still don’t really like it. It doesn’t address the concern of things getting harder, and apparently even harder for other countries’ poor too. It's an irrelevant argument. Sure, we can and should still be grateful for what we have in a developed nation, but that still doesn't mean everyone's quality of life is abounding in prosperity. When we compare the standard of living of poor people in America to the rest of the American population and know the capabilities and resources the country has to offer, I know we can do better. Comparing the standard of living of poor Americans in the 21st century to people from very poor countries in other parts of the world or even comparing to the poor living conditions of past human history is a false equivalence, red herring fallacy to divert attention and focus on a separate issue that only has a minute relation to the main issue. Apples and pears are both pome fruit, but they are not the same. A poor person in America is not a fair comparison to a poor person in Burundi. Poor Americans will obviously still have a better standard of living than a poor person in Burundi simply because of the different laws, government, social safety net, regulations, national resources, and proximity to services and technology when comparing the two nations. They are both poor people, but it's not an equivalent comparison. Final Comment I took from someone else when there was an argument about conflicting minimum wage studies. Some showed the benefits of raising them, others showed the negative effects:

Welcome to economics, where it’s a soft science yet passed off as a hard science. We don’t really know what raising minimum wage will do or not since it’s humans making decisions at the end of the day. And humans can’t be quantified no matter how hard as a society we believe it’s possible. You can look at places like Texas with a low minimum wage and see the decent living standards, but across the pond in Europe you can see how a high minimum wage also has decent living conditions. At the end of the day lots of economic theories today are used as justification rather than understanding. Much to the detriment of society as a whole. If we wanted to be truthful we would understand that there isn’t one way or one right answer to approach economics, but who does that benefit? Not the people who fund these institutions and studies. It is nearly impossible to control for other economic factors, so the results of these studies are... questionable. What is the worst job you’ve ever had? The first thing that comes to mind is various retail, fast food, call centers, and other customer service jobs where people have to deal with abuse from customers, and often managers, for low wages. MY worst job was working at a tire warehouse as a temp employee. I made a whole post about it here. What made it bad was the long days of manual labor putting studs in tires with pneumatic guns that didn’t work well, then a month of wandering the warehouse, pretending to busy, and often lifting very heavy tires into stacks, for low pay as a temp. job. It sucked. Let’s look at some other answers via reddit polls:

Gross. So the worst jobs can typically be categorized as the ones with the worst customers, worst managers, bad for mental health, tough working conditions, or just gross.

On another note, why are there so many managers with personalities that are so cruel? I had a manager that believed people learn better when beaten through fear or abuse, because it sticks with you. All this made me do was want to cover my tracks better, never approach him for anything and go to, like, everyone else first when I needed something. I hated that job and glad I’m not there anymore. Once things got tense that one time, they were never the same. A manager or coworker can’t be super rude and then expect us to just forget that ever happened and go back to normal. Maybe if there was some kind of apology and change, but that practically never happens, does it? In another story shared online, someone requested to time off to leave early a long time ago, which was approved, but when the time came for them to leave, as requested, managers made a big deal out of it: “The manager says, ‘Well hang on, let's go find (other manager's name) and talk to him.’ I remember thinking to myself how stupid and unnecessary this was. He took me across the warehouse to find some dude I've never met. So, I tell this guy that I will be leaving early today for my daughter's birthday at whatever time. Didn't have to include the reason, but just did because why the heck not. He gives an exaggerated sigh, then stares at his watch for some random reason and acts like this is the biggest inconvenience of his life! It was all for show, and I don't know why.” Continuing on with the theme of management being unreasonable for no good reason, the following story was shared: “One day, our machine that taped the boxes malfunctioned and we didn't notice at first. A box made its way down the line and the item fell out of the box. A guy came down to me and said, ‘If this happens again, we're gonna have a problem.’ He looked like a redneck Andy Bernard from The Office. Like, really cool dude. That's something to get that upset over, a two-pound item falling from a box. We all took our lunch break at the same time, 30 minutes. Coming out the rest room during one break, a manager started rushing me to get back on the floor. ‘COME ON MAN, NEED YOU BACK OUT THERE.’ I had 5 minutes. Everyone had 5 minutes. He knew what time it was. It was so unnecessary and stupid.” When I first had the idea to look into this topic, I guess I was expecting…more. More unusual, more crazy stories, more outlandish behaviors or difficult tasks or something, but reading through a lot of these felt like job experiences many of us have had and can relate to. It’s sad that many hardships don’t have to exit, but people gotta be people doing things people do for some reason. Original Article. A local business has been called out on social media after towing the line of saying "Nobody wants to work," drawing cards to pick which factors they want to blame others with, without looking inward at their own problems. The article reads: "As businesses continue to deal with staffing shortages, many are offering more money per hour in hopes of finding and retaining the much-needed help. In Medford, the beloved Donut Country is offering $17 per hour after three or four weeks of training in hopes of doing just that. Jamie Stewart, a longtime employee for Donut Country and the daughter-in-law to owner Susan Stewart, explained the business has always offered more than what the state’s current minimum wage does, but they have never seen a lack of candidates since pandemic restrictions eased in the beginning of 2021.” Sometimes very small, family owned and operated businesses can be uncomfortable to work for. Employee relatives can get away with a lot more bad behaviors and also receive unfair preferential treatment. Sometimes there’s just some kind of culture established within the family that leaves you feeling on the outs all the time. Continuing with the article: “Even with the small business offering $17 an hour, Stewart said it has been a challenge to find reliable help. 'Usually, we would get 70 plus applications per one position that we would have available. Now I have had a fryer position open for four or five months now and I have maybe got a handful of people,’ Stewart said. She said there have been several times where people go through the hiring process, accept the position, and start working, but leave after only a few hours on the job.’ Stewart said she has tried several different avenues to advertising the open positions, including on social media and in one of the most seen locations, Donut Country’s drive-thru. ‘Since a lot of us are family, some us do come in six to seven days a week, because we want to keep business going and help,’ Stewart said.” Now I’ll get to the community responses:

Leslie Peterson commented: “Interestingly, I actually applied here after I lost my job in healthcare. I applied for all kinds of things. Never got a call back. I don’t know if Leslie’s qualifications were lacking somehow, but several other people also commented about not hearing anything back from this company after applying. Shayna Renae Rossi also said, “Many people on this threat have applied with 0 callback. Many I know in person have applied with no call back. Apparently, it's not a joy to work there so they keep losing people.” Yikes. Merrylee Kruger fed into the “nobody wants to work” narrative saying, “The going wage is pretty much the same at fast food and everywhere. Let's face it. People don't want to work (sorry if this offends some of you out there).” Thomas Richard tagged along on this, adding, “It’s not offending if it’s true. I don’t work fast food anymore, but I see ‘now hiring’ signs all the time at fast food places and the wages they offer. I never thought I would see the day anytime soon where fast food employees could make a wage like that.” Susan Cullop also added, “You’re right. What would happen if they were told to get a job or no more benefit?” I shake my head at this attitude, but I used to think that way too. It’s cruel and ignorant. People out there really think that other people are getting paid by the government just because they don't want to work as if we already have universal basic income. Grayson Donnahue offered some insight: “Many don’t want to give up HUD housing, Oregon Health Plan, Oregon Trail Card, and ACCESS pays people’s utility bills.” But another user clarified that Access only pays utilities like 1 or a few times. They don’t just keep paying it to the same family indefinitely. So people get benefits because they are too poor and need them survive, but it’s not a great quality of life and, as far as I know, there are a lot of steps to qualify and keep these benefits. It becomes a poverty trap where people really can’t earn more because the higher earnings would disqualify benefits, but not be enough to pay their bills. It’s a big problem, but I find it offensive to just assume it’s always because people don’t want to work. Maybe some fringe cases, sure, but not the common attitude. Alright, I’ll start sharing the comments where community members started picking apart what’s really going on. Juanita Stovall: “Fry donuts for $17, Cook at Panda for $18-20 as advertised locally, or starting pay at bank...$22 no food flipping. The truth of the matter is folks can't afford the 14% rent rate cap increase at any of those rates.” Bryce Flory mentioned that “Donut Country has had hiring issues WAY before the pandemic. They would often have job listings on Craigslist. They have a high turnover rate which makes you think after a while that it’s not just the employees’ fault. Seventeen dollars is great but they have to call people back who have applied and figure out how to make it a better work environment so they can keep employees longer than a few months. BINGO! Cheyenne Riggs added: “Going to be hard to find someone to work for $17 bucks an hour when others are paying $20-$24 an hour. Just saying. If it's been 5 months trying to find someone for this position, I would look within the company and see what they're lacking.” Julia Bott commented: “What we are willing to pay for a donut is part of this equation.” This was an interesting comment because I can understand how you can only raise the pay offered to donut shop employees so much before you’d have to raise the cost of the donuts you sell, and I know people are only willing to pay so much for a donut before it’s not worth it. Josh Ridders touched on this a little more too adding, “There is no such thing as a living wage for a minimal skill set job. The only thing raising base wages accomplishes is making everyone that much poorer…you would think that was pretty evident...” My response: Do the business owners live on the earnings of this shop? I assume so. In that case there IS a living wage for minimal skillset if the “minimal skillset” employees end up running the shop. The owners had the capital to open shop, but apparently actually running the shop only requires a minimal skillset if they pay low or minimum wages. Looks like they need to take a pay cut by hiring someone at higher wages if they’re not in there doing it themselves, but I don’t know. I don’t know all the facts. I will end with Susan Farber’s comment: “When I was in my college and early twenties I rode a bike, lived with roommates (sometimes twin beds in one room to cut costs), worked at restaurants to get a shift meal for free, ate cereal for breakfast ‘til I worked up the ladder in management - to afford a reliable used car. Paid bills on time to establish good credit so a bank would loan me $600 when my engine blew up and required a rebuilt engine in my VW Bug. It takes sacrifice & responsibility.” Good for you Susan. Hard work and sacrifices are often important to investing in improving your life later, but your profile picture looks like you also went to college when it only cost like 300 bucks. Please don’t criticize the habits of younger generations when you don’t know the economic differences faced today. There are dozens and dozens of stories of this out there. Business owners and other people in general love to complain and blame any reason they can think of for people not wanting to work, but never look inward or apply some critical thinking to figure out what the real problems are. Original Article

I read stories like these sometimes because I'm interested in stories of people that found financial success in unusual ways, but many times these stories are dull, leaving out important facts and details, or they're boring because there's nothing that unusual. Sometimes they are dull and boring because they're missing some info that would be nice to know and because there's nothing that extraordinary. In this one, the successful side hustle of this person that made her a millionaire before turning 30 is...photography. Katelyn Alsop didn't have an interest in or take any classes on photography through high school or college but was still "artistic and entrepreneurial." She credits her start to one of her friends in college suggesting they go take some pictures of students around campus together, so 6 months later she starts a business, running it out of her dorm, and 8 years later she all the sudden was making a million dollars in profit!? "Sweet mother of goose, Jack!" How did this happen?! I've known many, and I mean MANY, wannabe photographers. It's usually just a girl with a camera that knows some minimal editing software. For a time I thought every 3rd girl I met claimed to be some kind of aspiring photographer with a photography business, but when they offered to take my pictures they're like, "What do you want? Where should I stand? Ok say, 'cheese.'" Snap, minor edits, done. Ok, so you're not a photographer, you're just a girl with a camera! I met REAL photographers later that knew how to do proper posing, use of lighting and background, focus centering, and great, clean editing. The REAL photographers knew what we wanted, but they knew how to really make the magic happen. They direct US, not us directing the photographer on how to do their job to make us look good, because I don't know that stuff. The difference was huge. So reading this story, I was a little offended that someone with no real training and an overwhelmingly common side hustle, somehow became a millionaire doing this!? Ok, so how? "In Alsop's first year of business, she was still a full-time college student, but she managed to spend at least 40 hours per week growing her photography side hustle: driving to shoots, editing photos and sharing the finished albums on her blog." Who are her clients?! Who's paying some random girl with no prior background to do professional photos and how many did she have right off the bat to be spending a full 40-hours a week on this? The article gives some attention to her blog, which became a portfolio source as well as a great marketing tool apparently. THAT's what I'm more interested in now. So she quickly got busier and was able to grow and charge more for her services, probably more selective on clients too, but the real money making business came from utilizing her blog and followers to start "selling online technical courses for photographers on her website in 2015. There are tutorials on editing, posing and lighting techniques, as well as business courses, like how to market your photography business and build an effective personal brand." "Alsop credits much of her success to the people she's surrounded herself with since starting her side hustle: college roommates who cheered her on when she cashed her first paycheck, her family and friends within the industry." This makes me wonder what real influence her friends and family had. Were they her first paying customers that had other connections to paying clients? Or were they only just moral support like she leads on and this business building was a miraculous lucky success? Because it was so successful, her husband quit his job (only 5 years after she started her thing in college) to help her run her business because it was already so successful, and she now has several other relatives working for her as well. Wow. This photography gig is wildly profitable! The reason I am curious about family involvement is because family money, connections, and expertise has a huge influence behind the curtain in MANY cases. For example, I read a story about an 18-year-old in my local area that was still finishing high school, but started a company, "Reselling Secrets," which was making $100,000 PER MONTH reselling shoes! What!? Article link. He did credit his entrepreneur skills to his parents, but the article never mentioned that his parents were a successful and wealthy artist and marketer that likely had a big hand in helping to start and blow up this operation. It's still a great story about a side hustle making it big, but I want to see behind the curtains more and know what EXACTLY people did to blow up and make it big. How'd you get more customers/clients and how'd you do your marketing? These articles usually just leave it at generic “they worked hard and stayed dedicated.” There’s NO INFO in that. So in 2022, "Katelyn James Photography brought in about $240,000 per month in revenue. A majority of that, roughly $230,000, is passive income from her online courses and trainings. The rest is from her photography business: Alsop typically shoots four weddings per year, charging at least $12,000 per event." Ok. End of story. I am surprised that the boring photography business just exploded into making millions when there are millions of "photographers" out there. I would be interested in a deep dive dissection of what all took place to make this happen. I have a small example of my own with my wife's experience. She works as a self-employed esthetician and was VERY LUCKY to be able to share a booth with someone else for free. There ended up being some bad drama with that, but that’s for another time to tell. She only got a few clients in her first year through friends and word of mouth. It was slow. She didn't have to go in and work very much. We also spent a ton of money to create a presence online and on ads with google, facebook/instagram, yelp, and some local sponsorships. We tweaked them a few times to be more effective, but we were blowing money on ads and not getting enough hits out of them. At the end of the year, she had to leave and rent a space at a new location. This new location had much younger partners that also had a strong number of followers for their crafts. They referred clients to my wife because it wasn't the type of work they did themselves, but now they shared a space together and referred to each other. My wife's first month at this new place was SLAMMED! She saw her own following grow profoundly. People following the other girls were referred to her, they liked her personality and work portfolio, so they started referencing her to their circles as well. Word of mouth spread and my wife's online following grew. It's very difficult to build up a following on your own, especially if you're in a new area without a lot of friends and family. No prior starting connections. This is why I think it's worth having these articles dig a little deeper to help people understand how they REALLY made it happen, so we all can have a better chance at making a better living. The question is asked, "How is the vast income disparity between business employees and business owners/executives not exploitation? There would be no business without the owners founding, but there would also be no thriving business if there weren't employees working the business." People are frustrated with the cost of living, not making enough money, and offended by growing income inequality. Let's look at some responses of what people have to say about this subject, and I'll add my commentary. 1) First and foremost, many argue that it's not considered exploitation simply because you agreed to it. Nobody is being FORCED to work at whichever job or location you're frustrated with. However, there is a point I will highlight at the end where just because someone chooses a better deal in a job, doesn't mean they're not being exploited when the vast income difference and company's ability to pay is considered. You agreed to the better deal, even though the fairest deal is hidden under the table during this agreement and deal making. People whine that it's not voluntary because you are forced to work or starve. I think this is nonsense and I don't understand how people make sense of it. Unless you are very rich to where your investments fully fund your living (which I understand people not liking this concept), you have to work SOMETHING to survive. You have to either work to build your own shelter and grow and raise your own food or work for someone that will give you money to buy those necessities. The voluntary aspect isn't the biological needs, it's the fact that you can choose which job you work and where you live. Obviously, there are situations that can be discussed on why some people have less choice and ability to move, and that's worth a conversation, but the reality is that we still have that voluntary aspect and can increase our own market value which should lead to better jobs. Here's a response I read online: "If you think you're being exploited, get a different job or start your own company. If you don't have the skills to do so, acquire them. I think this is a good response that covers all the common tropes, but let's talk about why people are upset about their situation and don't just "get a better job." 2) There's only so much someone can do. Not everyone is cut out to be a rich professional. Maybe it's too late for big career changes. Many think it's offensive to just say, "Get a better job" because it ignores the fact that this is hard to do and has a lot of barriers to make happen. Here's one response to this that I liked: "Sure, let me just jump to a $150K salary job. Why doesn't everyone do this? Increase your market value, sure, but doing so requires a lot of time and money invested, which people don't have. These decisions are important in your early 20s when you're deciding on and building towards a career path. If you don't make it then, you are royally screwed, and this attitude insinuates that everyone DESERVES to suffer. People agree to the best they can get, and the best isn't good enough. There is a limited amount of high paying jobs. The barrier to entry is too great for the rest." So why aren't there better alternatives? Why do people feel stuck like there is no choice? I'm going to leave this open for participants to weigh in, but I'll start with my own experience. I've thought often about changing careers to make more money, but everything I look at requires more education and time to dedicate starting out. I can't dedicate to full-time education because I have a family I still need to support. I have to keep working my current jobs. Note I said jobs with an "s." Suppose I go through with it and finish the required educational background. I now get to compete for jobs with people that have already been in the industry for years, or take a pay cut from where I’m currently at to start over in a new industry with no experience. Yikes! Yeah, there's some success stories of people that made it and that's great, but what about the people that didn't? What's their story? You can work in the same general industry and still hop jobs doing the similar type of work, but in most cases you'll eventually be capped out unless you get superior title changes. In my personal example, I've used this to get raises and keep my options open, but I reach a cap. Nobody would be willing to pay much more than where I was for the type of work I was doing, but I also lacked the knowledge and qualifications to get a superior title position/responsibilities. That required time to get that. So what's holding you back? Why aren’t you out there getting a better job; or maybe you did? Tell us about it! 3) "Start your own business" is the other common retort for this income disparity or low wage complaints. Starting a business takes a tremendous amount of costs. This isn't realistic to say to people and I find it disingenuous. Even low-cost startups take a lot of time and A LOT of marketing to make it profitable enough to be better than just working a job somewhere else, unless you have some serious connections to hook you up with clients/customers. This is a distraction from the general discussion about income inequality and it sounds like, "Oh, you have a problem with something happening on Earth? Why don't you just move to Mars and do it better there than?" Come on. 4) Business owners should be given some credit when they have built success stories and people need to understand this side too. Here's where I'll go into why owners feel justified in taking a lot of the business income.